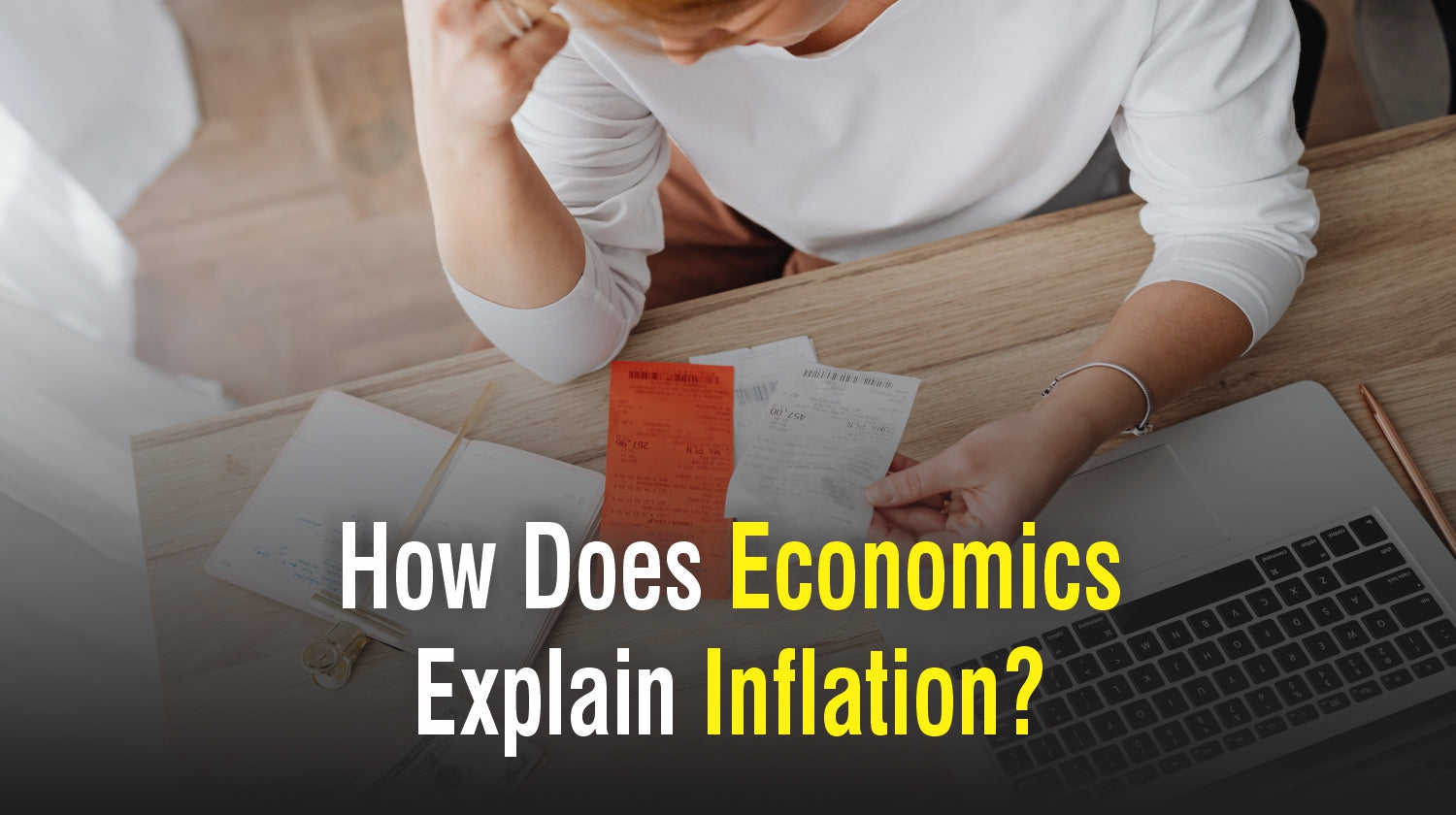

The pangs of inflation have been felt all around the world. In the US, the inflation rate was 7.7% in October 2022 and in India, it was 6.77%. The UK recorded its highest inflation rate at 11.1% in 41 years in 2022. After the Covid-19 pandemic, inflation has increased as a result of all the services re-opening but businesses not having the resources to provide the goods and services. But, let’s try to understand what is inflation.

What is inflation?

A price rise is considered inflation. It increases the cost of living in a country. By definition, inflation is the rise in prices during a given time period.

What are the factors behind inflation or price rises?

There are various reasons for price rises. Microeconomic theories like the law of demand, the law of supply, consumer preferences, cost of production, competition, and market condition are responsible for price rises. The book, Microeconomics Essentials You Always Wanted to Know deals with various microeconomic theories like demand, supply, consumer choice, the revenue of firms, cost of production, market, competition, etc. which are vital to understanding inflation in a country. The understanding of underlying reasons for inflation can help businesses and entrepreneurs take the right pricing decisions in an inflationary condition.

A piece of news dated January 12th, 2022 covered in www.usa.today.com comes with the tagline ‘Food prices up, shelves empty’. It blames the pandemic-related workers’ absence and warns about high inflation. The News report says the price of new cars went up during the last year by 11.8 %, and groceries were dearer by 6.3 %. Chicken and fish prices jumped by 10.4 and 8.4 % respectively.

How do we explain these changes in price?

When we analyze the above situation, the price rise was due to the absence of workers in the production process. So, workers’ absence led to a short supply. In economics, we deal with the theory of supply and demand. If the demand increases, the price goes up. If the price goes up, demand falls. In case of an increase in supply, the price falls. Again, in case of an increase in price, suppliers are motivated to produce more and supply more. The price is dependent on the supply and demand of goods. There is a shift in consumer demand due to consumer preference and income level. It also shows how the production cost determines the supply of various materials. The production cost is determined by the prevailing wages, raw material cost, cost of electricity, and many other productions related factors”

Conceptually, purchasing power is the ability of the customer to pay for the goods. Now when the price goes up, consumers' purchasing power goes down. This may have a negative impact on the lifestyle of the consumers. This is the primary reason why Central Banks and Governments try to control inflation in a country. You can read more about purchasing power in the book, Financial Management Essentials You Always Wanted To Know.

Steps taken to control inflation

Usually, the central bank in a country tries to taper the money flow in the economy to control inflation. When there is less money in the hands of the people, the demand for goods comes down, making the prices stable. However, this is not applicable when the inflation is due to supply-side constraints i.e. less production due to the unavailability of laborers or issues with the supply of raw materials. Sometimes, due to natural calamities, drought, etc. farm production may drop leading to price rises in food items.

Governments sometimes try to increase imports and curb exports to control inflation but economists do not find this sustainable.

About the Author - Prof. Amlan Ray is currently Senior Director & Dean at SRISIIM, New Delhi, a management and research Institution recognized by theMinistry of Science & Technology andMinistry of Education, Government of India. He has 27 years of experience working inCorporates, Consulting, Training, and Academia.